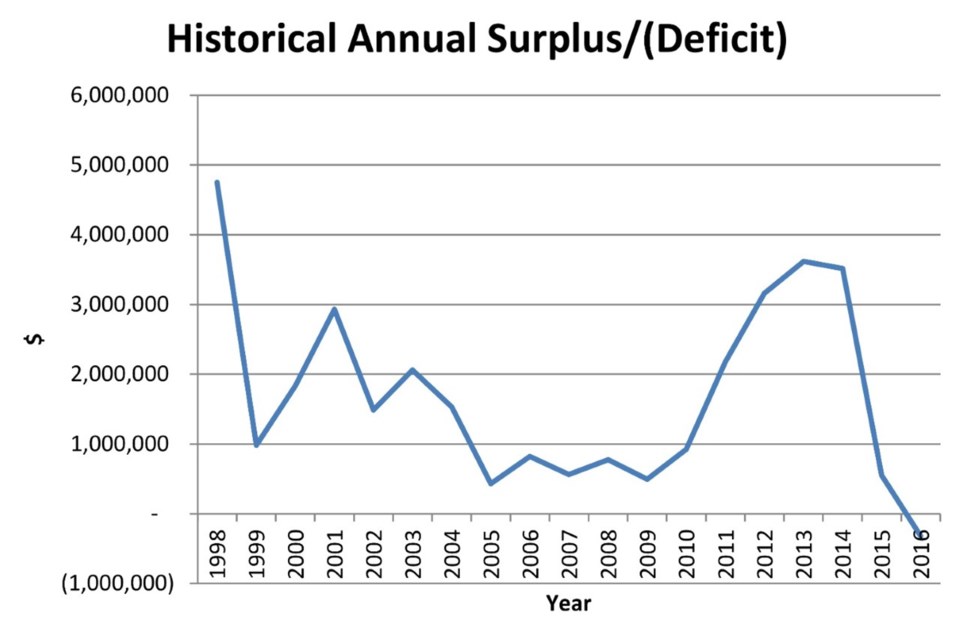

Budget surpluses aren't what they used to be. But city staff are pushing to have all leftover funds set aside for tax stabilization, capital reserves and paying down long-term debt

First they write the budget.

Then they spend the money.

But happens when City Hall doesn't spend all the money and there's a surplus left at the end of the fiscal year?

Shelley Schell, the city's treasurer and chief financial officer, will be pushing Monday night for a surplus management policy to answer that question.

Schell says that the Municipal Act makes cities, towns and other municipal governments have balanced budgets.

Any surplus must be carried forward into the following year as a revenue for the operating budget.

"This may be deemed to be positive because the surplus partially off-sets any need for an increase in the tax rate in the subsequent year," Schell says.

"The downside of this requirement is that once a surplus has been carried forward in this way, it must be maintained because the reduction or elimination of it will create a pressure in the following year’s operating budget."

"Where municipalities have had surpluses, there is a need to maintain consistency from one budget year to the next to avoid significant budget pressures, or unsustainable revenue increases. Staff has historically recommended that any surplus be used for one-time items as they cannot be relied upon as an ongoing revenue source in future budget periods," Schell says in a report prepared for City Council.

The following is what Schell wants to do with any future surpluses, together with her explanations in her own words.

Monday's City Council meeting will be livestreamed on SooToday starting at 4:40 p.m.

*************************

1) Tax stabilization reserve - 40%

The purpose of the reserve is to smooth property tax increases. The reserve can only be accessed if the tax increase would otherwise be in excess of core inflation. Use of fund must have an 'exit strategy' to reduce future dependency of the operating budget on the fund. This reserve was fully utilized in the 2016 budget and has not been replenished. This reserve assists council and staff to mitigate and smooth unusual items in the operating budget. Replenishing this reserve should be a high priority.

2) Capital reserves - 30%

Allocation of to the capital reserves will assist with the deficit in the long-term funding of the asset management plan. It will be utilized to offset potential long-term debt requirements or one-time projects rather than annual operational capital allocations.

3) Long-term debt - 30%

Internally funded long-term financing arrangements can be paid down quicker, thus allowing for either new debt servicing or budgetary reductions. External long-term debt typically does not have options for early repayment but will also be reviewed when surplus funds are available.

*************************