Registered retirement savings plans are not a good idea if it looks like you'll be on guaranteed income suppliments in your old age, says Richard Shillington.

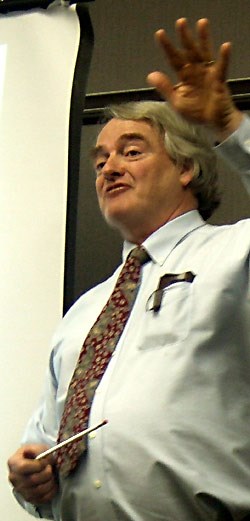

In two full-house forums at the Holiday Inn yesterday, Shillington, a seniors' pension expert, said that many financial advisors are giving bad advice.

"The calculations financial advisors do never include GIS clawbacks," he said last night.

Shillington, an expert versed on Canada Pension Plan, Old Age Security, Guaranteed Income Supplement, and Canada Pension Disability, Spouses Allowance, Widows Allowance and Veteran's Benefits, appeared with Sault MP TOny Martin yesterday.

He recommends that people with low incomes and little chance of ending up with a company pension would be much better using their money to pay down their mortgages.

"I call it the policy paradigm," he said. "Lower income Canadians are punished for saving money while higher income Canadians are rewarded."

Shillington said policies like Bill C-36 result in clawbacks of large amounts of money from low-income seniors trying to cash in their RRSPs when they are most financially vulnerable.

"For every dollar you [low-income Canadians] save, you've demonstrated you don't need it so we'll take one away," he said. "For every dollar you [high-income Canadians] save, the government wants to reward your savings with more."

To find out more about Shillington's advice on retirement for 'the rest of us', as he calls people not lucky enough to have an employer pension plan, visit his website.