A proposed 2023 budget to be presented at Monday's city council meeting calls for a 5.97 per cent levy hike.

"The 2023 budget is one of the most financially challenging budgets in recent years," says Shelley Schell, the city's chief financial officer.

"The current level of service provided by the many city departments may not be able to continue in the near future without significant investment, savings initiatives or changes to the level of service," Schell says in materials prepared for Monday's council meeting.

Schell and city chief administrative officer Malcolm White will propose a $203 million operating budget and a $48 million capital budget.

"Notably, over half of the capital budget is allocated to road work, a continuing high priority for staff and the community," says CAO White.

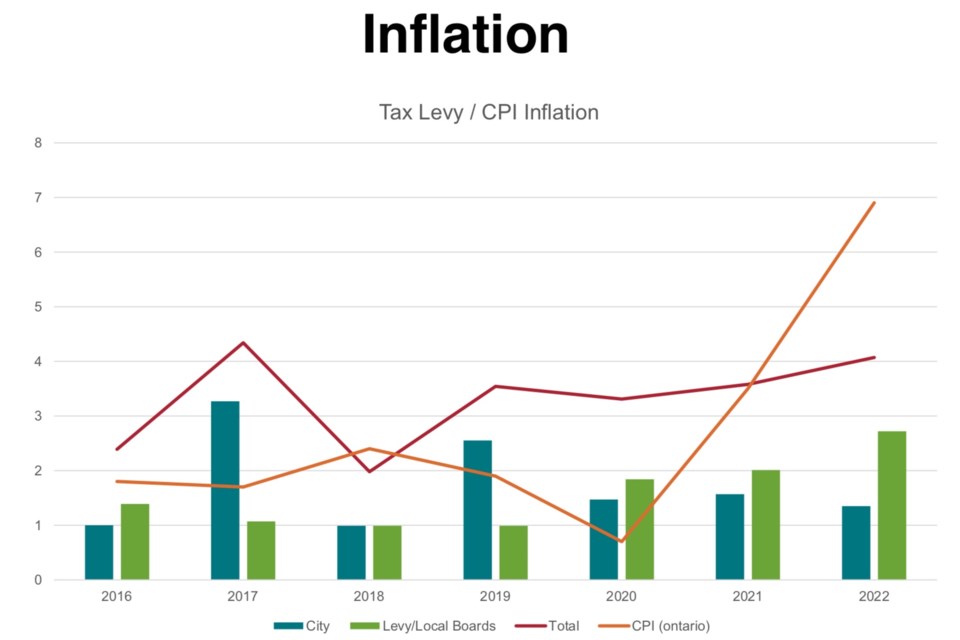

City staff propose spending an additional $5 million to maintain existing services, accounting for 3.95 per cent of the levy impact.

Another two per cent of the levy hike ($2.6 million) is attributable to levy boards and local boards over which the city has limited or no control.

Highlights of the proposed budget include:

- circumventing its own debt management policy, the city would use internal debt for 2023 fleet requirements for public works and fire services

- the first of four annual increases in the public works capital investment will be funded with $550,000 from retired debt servicing. This allocation will be used in the short term to service internal debt for the fleet backlog catch-up and then for ongoing fleet replacement requirements

- Fire Services will be allowed to hire four full-time firefighters to reduce overtime costs and decrease the risk of service level shortages. $107,000 saved from this measure would be added to a fire capital reserve fund to be used to service internal debt required for the fire fleet 2023 capital requirements

- a one-time expense of $50,000 would provide for a long-term financial plan, with funding provided through an asset management reserve

Of the $5 million increase proposed to maintain existing municipal services, $3.25 million is attributed to contractual increases and $1.3 million to resolutions made by city council.

Can Saultites afford all the services currently provided by the city?

In a report prepared for Monday's city council meeting, White and Schell offer the following observations:

The Ontario Living Wage Network calculates the standardized living wage rate across the province, which is the minimum hourly wage needed to cover basic expenses. The organization also certifies employers who provide a living wage.

The 2022 release of the living wage data stated that Sault Ste. Marie had the highest increase over last year’s living wage at 21.6 per cent.

In reviewing the data in the Ontario Living Wage calculation archive, Durham was reflected as the highest increase at 30.1 per cent. Durham is now grouped with the GTA region and not as a separate calculation in 2022.

The Ontario Living Wage Network changed their methodology for 2022.

Previous to 2022, Sault Ste. Marie’s living wage was based upon our distinct living wage area.

In 2022 it was grouped in the north region along with Sudbury and Thunder Bay.

In 2021, Sault Ste. Marie was 1.78 per cent less than the average of the north communities...

By moving to a regional methodology, the increase for Sault Ste. Marie in 2022 will be overstated due to the inclusion of higher-cost municipalities, but it will still reflect one of the highest increases.

The trend from the living wage data is relevant.

Significant increases in all regions of Ontario are reflected in the 2022 living wages.

The north region, based upon an average change, is still one of the highest increases year over year. The living wages range from $18.05 in the London region to $23.15 for the Greater Toronto Area.

The north region is in the middle of the data regions at $19.70.

The increase in the living wage is indicative of and supports that inflation in the community is significant.

All of these factors influence the tax levy increase for 2023.

Service affordability and what the community is willing and able to pay to maintain the current levels of service may be impacted by these inflationary pressures.

Preliminary budgets are usually whittled down by city councillors.

Further budget deliberation meetings are planned for Feb. 13 and 14.

Tax rates will be set in March and April 2023.

Monday's city council meeting will be livestreamed on SooToday starting at 4:30 p.m.