NEWS RELEASE

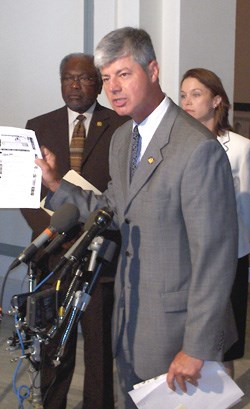

CONGRESSMAN BART STUPAK 1ST CONGRESSIONAL DISTRICT OF MICHIGAN

************************* Bart Stupak warns taxpayers of tax refund scam

WASHINGTON - Congressman Bart Stupak (D-Menominee) cautioned constituents of a widely circulated e-mail scam that claims to offer a tax refund from the Internal Revenue Service, but is actually designed to steal individuals’ identities.

“The fraudulent e-mail is designed to look legitimate by including an official IRS logo and an ‘irs.gov’ e-mail address,” Stupak said. “The e-mail leads recipients to an online form that is designed to steal the recipient’s personal identity information, such as social security number and credit card numbers.”

Identity thieves can use stolen identity information to charge up debt to the identity theft victims’ accounts, and apply for loans, credit cards or other services in the victim’s name.

Stupak advised constituents who receive the fraudulent e-mail not to reply to it and to promptly delete it.

“The IRS does not use e-mail to contact taxpayers about issues related to their accounts,” Stupak said. “Official taxpayer contact usually includes a letter on IRS stationery in an IRS envelope. IRS letters also contain a contact phone number.”

The U.S. Federal Trade Commission estimates that as many as nine million Americans have their identities stolen each year.

Copy of the fraudulent e-mail:

- Original Message -

From: Internal Revenue Service [mailto:[email protected]] Sent: Wednesday, September 19, 2007 9:51 AM

Subject: Tax Refund

After the last annual calculations of your fiscal activity we have determined that you are eligible to receive a tax refund of $116.40.

Please submit the tax refund request and allow us 6-9 days in order to process it.

A refund can be delayed for a variety of reasons.

For example submitting invalid records or applying after the deadline.

To access the form for your tax refund, please click here.

Regards,

Internal Revenue Service

© Copyright 2007, Internal Revenue Service U.S.A..

Confidentiality Note: This e-mail is intended only for the person or entity to which it is addressed, and may contain information that is privileged, confidential, or otherwise protected from disclosure. Dissemination, distribution, or copying of this e-mail or the information herein by anyone other than the intended recipient(s) is prohibited. If you have received this e-mail in error, please notify the sender by reply e-mail and destroy the original message and all copies.

*************************