A preliminary 2016 budget calling for a 5.23-percent levy increase goes to city council on Monday.

If approved, the budget would raise taxes $124 on an average residential property assessed at $175,000.

City staff say a 1.8-percent levy increase is necessary just to maintain existing city services.

"Of the 5.23-percent levy increase, two percent relates to surplus and reserves used in the prior year for levy reduction," city staff say in briefing materials prepared for City Council.

"Use of surplus for levy reduction has increased significantly since 2010 as larger surpluses were experienced. The increase in the level of surplus was due to several unique circumstances and staff project that these levels will not be seen in the future," a staff report warns.

"As such, an increase to the levy will be experienced due to the change. Staff continues to recommend that surplus not be used for levy reduction and rather be applied to one-time items in order to maintain a stabilized levy."

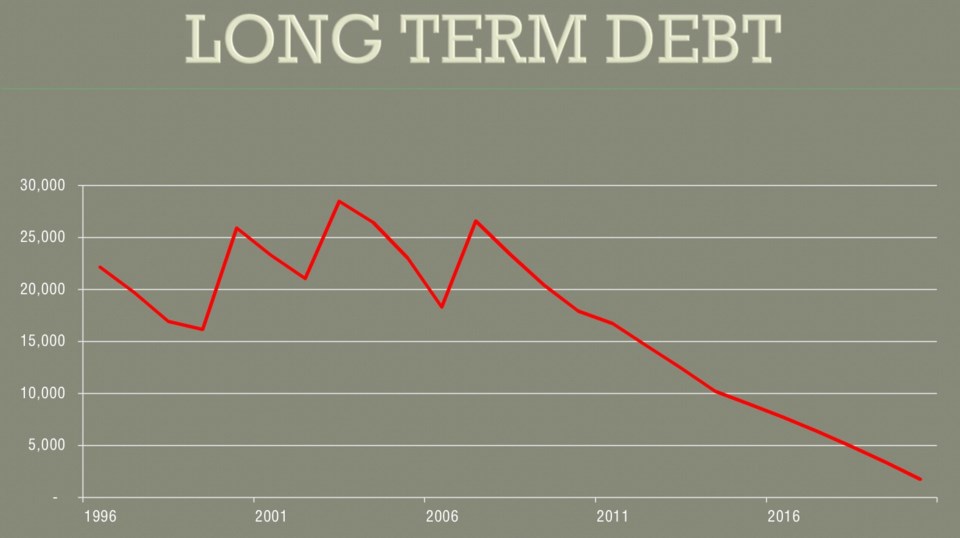

The preliminary operating budget calls for no additions to long-term debt, although options increasing long-term debt financing are expected to be considered during budget deliberations.

Sault Ste. Marie's tax rate is higher than Sudbury's or North Bay's but lower than Thunder Bay's.

But Sudbury and North Bay have higher assessment value than the Sault.

"By viewing only the tax rates, a false impression is given that Sault Ste. Marie taxes are among the highest, when in fact property taxes as a percentage of a taxpayer's income (which is a recognized benchmark used to compare municipalities) are the lowest," the staff report states.

Public open houses on the 2016 budget will be held in the Civic Centre's Russ Ramsay Room on Wednesday, February 17 from 7-9 p.m. and Saturday, February 20 from 2-4 p.m.

E-mail submissions may be sent to [email protected]

This year, the city has also introduced a new online budget input tool.

All input received will be summarized and submitted to city councillors for consideration during their budget deliberations.

The final draft of the 2016 city budget will be submitted to city council in April.