NEWS RELEASE

ALGOMA CENTRAL CORPORATION

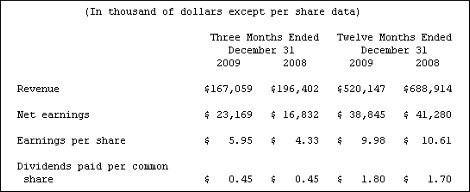

************************* The corporation is reporting net earnings for the three months ended December 31, 2009 of $23,169,000 compared to $16,832,000 for the same period in 2008.

This increase in net earnings of $6,337,000 was due primarily to the following:

- Decreases in earnings of ccean shipping segment due primarily to fewer operating days as a result of a vessel dry-docking.

- Increase in earnings of the product tanker segment due primarily an increase in operating days.

- Increase in net foreign exchange gains of $3,162,000 resulting primarily from gains on the translation to Canadian dollars of U.S. dollar denominated debt due to the strengthening of the Canadian dollar.

- A reduction of income tax expense in 2009 of $6,127,000 due primarily to lower future corporate income tax rates and a special deduction relating to costs incurred on pollution control equipment.

Twelve-month results

In 2009, the corporation is reporting net earnings of $38,845,000 compared to net earnings of $41,280,000 for 2008.

The decrease in earnings of $2,435,000 was due primarily to reductions in operating earnings net of income tax and an increase in financial expense.

The decreases were a result of the following:

- The domestic dry-bulk segment's operating earnings net of income tax in 2009 were $3,230,000 compared to earnings of $12,797,000 for the comparable 2008 period. The decrease in earnings was due primarily to fewer operating days of the fleet due to the economic conditions in 2009 and an increase in repair and maintenance costs. These decreases were partially offset by gains on disposal of assets which consisted primarily of the gain on the insurance proceeds on the loss of the Algoport.

- The operating earnings net of income tax of the ocean shipping segment decreased from $21,135,000 in 2008 to $15,943,000 in 2009 due primarily to a reduction in results of the international commercial arrangement and higher operating costs.

- The real estate segment operating earnings net of income tax decreased from $5,256,000 in 2008 to $3,437,000 in 2009 due primarily to a gain in 2008 on a sale of a property and reduced earnings in 2009 due to the temporary closure of the hotel operations for renovations.

- Financial expense in 2009 increased to $4,941,000 from $1,444,000 in 2008, due primarily to an increase in borrowings to finance capital expenditures along with costs incurred in 2009 associated with expanding the corporation's credit facilities.

These decreases were partially offset by the following:

- An increase in the operating earnings net of income tax of the product tanker segment. The 2009 operating earnings net of income tax were $8,107,000 compared to earnings of $6,673,000 in 2008. This increase was due primarily to costs and out-of-service days associated with the 2008 planned regulatory dry-docking of the Algoma Hansa. This improvement was partially offset with reductions in earnings of the domestic tanker fleet due to regulatory dry-docking costs. There were two planned dry-dockings in 2009 compared to one in 2008.

- The net foreign exchange gains on the translation of foreign-denominated assets and liabilities were $3,387,000 compared to a loss of $4,699,000 in 2008. The gains and losses in both years are related primarily to the translation to Canadian dollars of foreign-denominated debt. During 2009, the Canadian dollar strengthened relative to the U.S. dollar after weakening throughout 2008. In addition, in 2008, the corporation had foreign exchange gains on the translation to Canadian dollars of Euro-denominated short-term investments.

- The income tax expense in 2009 was $386,000 compared to $12,308,000 in 2008. The decrease of $11,922,000 was due primarily to a reduction in the earnings before taxes in the corporation's future income liabilities due to an announcement in 2009 by the Ontario government to reduce the income tax rate in the future, and the recognition in 2009 of the income tax benefit of a deduction relating to costs to acquire new pollution control equipment.

*************************