The City of Sault Ste. Marie is being forced to spend about $300,000 a year enforcing provincial rules that make it very difficult for local charities to raise money, Mayor John Rowswell says.

"We don’t even like the rules," the mayor told a public meeting last night.

"And yet we’re forced to pay to administer them."

The cost to the City of overseeing lotteries, games of chance and other fundraisers is about $300,000, Rowswell says.

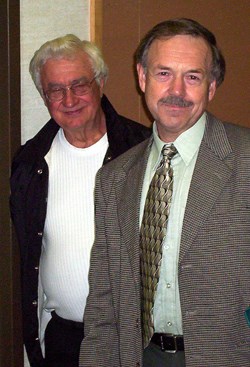

City Tax Collector Garry Mason (shown in front with Gary Latvanen, past president of the Greenbelt Bingo Association) told last night's meeting that the demands of regulating charities has forced him to remove staff from tax-collection duties to deal with them.

Alcohol and Gaming Commission of Ontario

Mason's department is obligated to provide financial information upon request to the OPP for their fraud investigations, and also has to answer for missing or incomplete information and strict enforcement of Alcohol and Gaming Commission of Ontario regulations, Mason said.

For about three hours last night, the Mayor and members of the Not-For-Profit Funding Review Committee heard from representatives of charities with stories to tell.

Each organization outlined how the services they try to deliver are being very negatively impacted by a lack of fundraising opportunities in Sault Ste. Marie.

"Businesses need to know that the social service supports are in place for employees and their families should they need them," said Sault Ste. Marie United Way Executive Director Gary Vipond.

Vipond reminded the committee that community supports for people in situations such as a hearing loss, depression or spouse abuse, among many others, are critical to the well-being of our community.

Office expenses can't be paid with gaming money

Like many at the meeting, Vipond expressed concern that the stringency of Alcohol and Gaming Commission of Ontario regulations is making it very difficult for not-for profit agencies to survive, let alone provide the services they are mandated to deliver.

"Items such as telephone and office expenses used exclusively for program delivery cannot be funded through gaming, however it is not possible to operate the program without these components," he said.

Most of the written or verbal submissions by 21 groups talked about how cost and difficulty of fundraising are consuming too much time and funds needed for service delivery.

"The local economic situation has not helped fundraising in Sault Ste. Marie," Arts Council of Sault Ste. Marie and District President Bill Slingsby told the committee. "With more local charities fighting for fewer local dollars, competition is fierce and the risk factor has increased," "Profits from fundraisers are decreasing as more promotion and fanfare is required, and sponsors are getting much harder to find," Slingsby added.

Common points of issues raised

- rigid licensing rules place too excessive restrictions on where funds may be spent

- licensing fees and paperwork are prohibitive

- much of the money that was being raised by local groups is now going to casinos

- not enough money from casinos is returning to the community through the Trillium Foundation

- regulations for getting licenses and distributing funds vary considerably from community to community, with Sault Ste. Marie being a community that tends to more strictly interpret Alcohol and Gaming Commission of Ontario regulations.

Use of casino finds questioned

Charity groups asked the City to lobby the Ministry of Consumer and Business Services, and to also examine the City's own funding formulas, especially regarding distribution of casino funds.

Other suggestions included a blanket license for fund raising groups, as well as tax breaks and other supports to not-for-profit groups in the Sault.

Mayor John Rowswell, chair of the Not-for-Profit Funding Review Committee, told presenters their information would be used to lobby for changes in the Alcohol and Gaming Commission of Ontario regulations.

Upcoming meetings

He also invited the charities back to City Council on October 18 to present their concerns to both Council as a whole and to Robert G. Han, co-author of the charity casino impact study.

Rowswell said Han will present the findings of a five-year retrospective report.

The Mayor said his committee will begin compiling its information as a report at an open meeting on October 4.

The report will be submitted to Jim Watson, Minister of Consumer and Business Services, by the end of October.

*********************** (EDITOR'S NOTE: An earlier version of this article quoted Mayor Rowswell as saying that the City spends about $900,000 a year overseeing over local charities. The Mayor confirms using that figure, but tells us it was in response to a question about the City's share of the cost of maintaining MPAC, the Municipal Property Assessment Corp.)

***********************