United Steelworkers Local 2251 will ask a Toronto judge tomorrow to terminate the five-month-old sales and investment solicitation process aimed at finding a buyer for Essar Steel Algoma.

The legal tactic is aimed at preventing term lenders from continuing to bid for the Sault steel mill now that Manhattan-based private equity firm KPS Capital Partners LP has withdrawn as their bid partner.

If accepted by Justice Frank Newbould, the application would clear the way for a second Local 2251 request: opening discussions with Ontario Steel Investments Ltd., a new firm set up by Essar Global, parent company of Essar Steel Algoma.

Local 2251 is Essar Steel Algoma's largest union, representing more than 2,200 hourly workers.

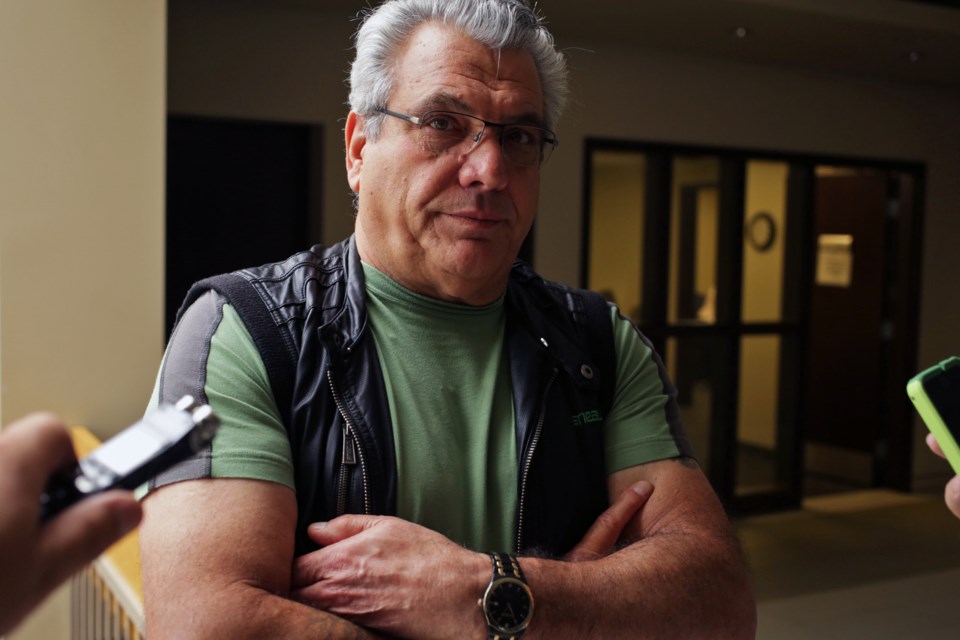

Mike Da Prat, Local 2251 president, says he wants the sale process scrapped because, without KPS's involvement, a standalone bid by the term lenders:

- lacks experience in successfully managing turnarounds of financially distressed companies

- lacks the committed resources or experience needed to direct and implement initiatives necessary to stabilize and turn around the business.

- lacks hands-on experience managing in the metal sector

- lacks hands-on experience in negotiating arrangements with existing stakeholders, including the United Steelworkers of America and government entities

Last month, a joint offer from KPS and the term lenders was determined to be the successful bid.

However, KPS withdrew from the process last week after Local 2251 indicated it wanted to deal instead with Essar Global subsidiary Ontario Steel.

"KPS brings a considerable amount of bench strength to the table," Da Prat says in a court affidavit.

"KPS is a highly qualified partner with extensive experience in successfully managing turnarounds of financially distressed companies. In particular, KPS has significant 'hands-on' experience managing portfolio companies in the metals sector, including the successful negotiation of arrangements with existing stakeholders such as unions, including the United Steelworkers of America and government entities," he says.

Da Prat argues that the term lenders shouldn't be allowed to proceed on their own because without KPS they aren't the approved successful bidder and lack the resources, experience and expertise to continue.

"Given that there is no other approved bidder left in the SISP [sales and investment solicitation process], it is clear that the SISP is automatically terminated. This affidavit is sworn in support of a motion to declare the termination of the SISP and disqualifying the term lender and for no improper reason," Da Prat said.

In a separate court application, Local 2251 is asking that Ontario Steel be recognized as a qualified bidder, even though Essar Global was previously rejected because it was perceived as lacking financial wherewithal to close the deal.

"The shareholders of Ontario Steel are the same shareholders of Essar Global Fund Ltd. and Essar North America Inc." the union states in its notice of motion to Judge Newbould.

Local 2251 says it likes the Ontario Steel bid because:

- union rights under the collective agreement will be protected

- the pension plan is preserved

- OPEBs (other post -employment benefits) are protected

- the purchase price meets or exceeds requirements of the SISP

- uncertainties about the Port of Algoma and the co-generation plant will be resolved, seeing that the purchaser and owner of those facilities are part of the same parent firm

- Ontario Steel has promised to try to reach a mutually satisfactory deal with senior secured note holders

On the issue of financial viability, the union says it's received "substantial information" verifying that Ontario Steel has more than enough cash available through its shareholders to close the deal and raise whatever other cash is needed to keep Essar Steel Algoma running.

While Local 2251 didn't meet KPS officials until very recently, the New York company has been dealing with other Steelworkers representatives for months.

The union's legal application comes as there are rumours of yet another potential bidder for both Essar Steel Algoma and the former Stelco mills in Hamilton and Nanticoke, in the form of London, UK-based Liberty House.

The following statement was issued by the United Steelworkers last week:

*************************

SAULT STE. MARIE, ON, July 14, 2016 - The United Steelworkers (USW) learned today that KPS Capital Partners (KPS) is withdrawing from the bid for Essar Steel Algoma Inc. ("Algoma") and that certain of Algoma's term lenders will be pursuing the bid independently. This is the latest twist in a mismanaged sale and investment solicitation process (SISP).

The process so far has ignored the advice of key stakeholders who have a functional veto over the restructuring, and prematurely excluded bidders. This flawed process lacked the bid tension needed to allow difficult decisions to be made in an informed way.

The USW will call for the process to take better account of the interests of key stakeholders in future.

"We know KPS. They are a top-notch fund run by recognized professionals," said Marty Warren, USW District 6 director.

"The USW has been speaking with KPS for months. USW Local 2724 met with them twice, including one time where the entire local executive flew to Toronto. The USW Local 2251 executive met with them only a week ago." (USW Local 2251 represents hourly employees at Algoma's operations in Sault Ste. Marie, while Local 2724 represents salaried employees).

"The USW understands KPS could have brought a lot to the table," Warren said. "But what they bring comes at a very steep price for the workers. It is hard for a local union to recommend to its members that they pay such a high price when there are other serious bidders out there who appear to be offering materially better terms."

"Recommending our members make such a massive sacrifice becomes impossible when the sale process lacks any ability for the local union to test the different proposals against one another," added Tony DePaulo, assistant to the USW District 6 director.

"With such a flawed process, everyone starts doing their own thing. Unfortunately, that is what we are seeing now. I don't know what the company was thinking. I've been through lots of CCAA cases. I've never seen anything like this," DePaulo said.

With respect to the term lenders, Warren had this to say: "I'm not even sure if we know who the term lenders are. So far, the only faces that they have put forward are those of their financial advisors and lawyers and once this process is over those guys will be gone. It is hard to see what they can bring to the table besides money. All the bidders have that, and it seems that other bidders are prepared to leave more of it with the workers in Sault Ste. Marie."

Going forward, the USW would like the restructuring effort to be more responsive to the interests of key stakeholders and is considering bringing a motion to the court seeking relief to that effect.

"We are opposed to the SISP process and the way it has been handled to date," said Lisa Dale, president of USW Local 2724 at Algoma.

"With KPS withdrawing its bid, we now have the opportunity to put the restructuring back on track, with a process that truly addresses the interests of our members, our pensioners and our community," Dale said.

"There is still a lot of interest out there and a lot of goodwill among a number of stakeholders to get to a deal that has a reasonable possibility of closing. The Steelworkers are certainly willing to be involved," said Warren.

*************************